Government Downsizing Scheme

Learn about the Australian Downsizer Super Contributions Scheme. Find out eligibility criteria, and how the downsizer superannuation rules work.

What Are The Downsizer Contribution Rules?

The Downsizer Contribution Rules allow homeowners aged 55 and over to make a one-off, post-tax contribution to their superannuation of up to $300,000 per person (or $600,000 per couple). Importantly, this contribution does not count towards the superannuation contribution caps, making it a significant financial tool for retirees looking to boost their savings.

How Popular Is the Government Downsizer Scheme?

Since its introduction in 2018, the scheme has grown in popularity, with over 60,000 Australians taking advantage of it by 2023.

According to the Australian Taxation Office, $14.5 billion has already been contributed to superannuation through this scheme, demonstrating its effectiveness in helping older Australians increase their financial security during retirement.

How Do the Downsizer Contribution Rules Work?

- Eligibility

Homeowners must be 55 years or older and have owned their home for at least 10 years before selling.

- Contribution Amount:

Up to $300,000 of the sale proceeds can be contributed to superannuation. Couples can contribute a combined total of $600,000.

- Time Frame:

The contribution must be made within 90 days of receiving the sale proceeds.

- Tax Benefits:

The contribution is tax-free and does not count towards your concessional or non-concessional superannuation caps.

Downsizer Scheme Example:

How it can improve retirement finances?

A homeowner and her partner are both eligible and sell their family home for $1.2 million. After paying off the mortgage and other fees, they have $800,000 in net sale proceeds. They can each contribute $300,000 (a total of $600,000) to superannuation, significantly boosting their retirement savings. Assuming a 5% return, this extra contribution could allow them to generate an additional $30,000 in income annually, offering more financial security and flexibility in retirement.

How iDownsize Can Help

FACT: The biggest roadblock to downsizing you’re likely to face is finding a suitable home to buy. Most people won’t sell their existing property until they’ve found the new home first.

FINDING THE PERFECT HOME

At iDownsize, we simplify the search process by providing homeowners access to off-market properties. These homes account for 25 per cent of all sales but never appear on the major real estate websites. It’s easy to find properties that:

- Match your style

- Meet your lifestyle needs

- Enjoy the right location

- Fits within your budget

By matching you with ‘hidden’ off-market properties tailored to your needs, you can downsize with confidence. And if appropriate, take full advantage of the Australian downsizer superannuation contribution rules.

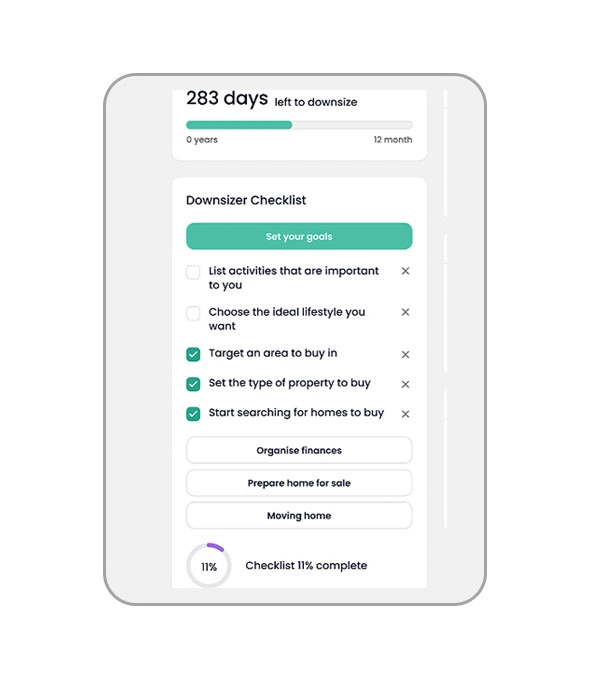

HOME DOWNSIZING CHECKLIST FOR OVER 55’S

Make downsizing real estate a breeze, with our free interactive downsizer checklist! It’s a powerful, easy-to-use tool designed to simplify your downsizing journey and help you keep organized. It breaks the process into clear, manageable steps:

- Set downsizing goals

- Organise finances

- Prepare the home for sale

- Moving home

This digital downsizing checklist is a practical way to stay in control, while making informed decisions. It helps downsizers reduce stress, avoid common pitfalls, and track overall progress. You can even customise it to your own situation.

Best of all, it’s completely free! EXCLUSIVE to iDownsize.

Frequently Asked Questions

The Australian downsizer superannuation contribution scheme was established to address two key challenges: the growing need for older Australians to improve their retirement savings and the housing market's demand for larger family homes. Many seniors were facing financial shortfalls in retirement, but were "asset rich, cash poor" due to the value of their homes. At the same time, families were struggling to find larger homes in a tight housing market. By encouraging seniors to sell their homes and downsize, the government aimed to free up housing stock for younger families, while allowing older Australians to contribute a significant portion of their home sale proceeds to their superannuation, boosting their retirement income and overall financial security. This initiative creates a win-win situation for both retirees and the housing market.

This scheme is available to individuals selling their principal residence, which must be exempt from capital gains tax under the main residence exemption. You can access the scheme even if you have reached your superannuation contribution age or already maxed out your superannuation limits.

The 10-year rule in the Australian downsizer superannuation contribution scheme requires that homeowners must have owned the property they are selling for at least 10 years before they are eligible to make a downsizer contribution to their superannuation. Here’s how it works:

**Principal Residence Ownership**:

The property must have been your principal place of residence for at least 10 continuous years leading up to the sale. This ensures that the scheme is used by those who are genuinely downsizing after long-term ownership.

**Ownership Timeframe**:

The 10-year period is counted from the date of ownership, which is typically the settlement date when you purchased the property. This period must be continuous, meaning any break in ownership or major change in property usage could affect eligibility.

**Property Transfers**:

If the property was transferred between spouses during this time (e.g., as part of a will or family law settlement), the ownership time still counts towards the 10-year requirement.

Once the property has been sold, and assuming all other eligibility criteria are met, homeowners can make a downsizer contribution to their superannuation from the sale proceeds, helping them improve their financial security in retirement.

No we do not. iDownsize is an online marketplace that facilitates introductions to providers who specialise in support services to downsizers. If appropriate, we may refer you to a fully licensed and qualified financial adviser experienced in retirement planning. It is up to you if you proceed with the service, or not. If you do, any referral fee we receive from the provider will be fully disclosed to you.

NOTE: This page is for informational purposes only and does not constitute financial advice. When seeking to utilise the Government’s downsizer superannuation scheme, it’s recommended you consult a licensed financial adviser or speak with your super fund.